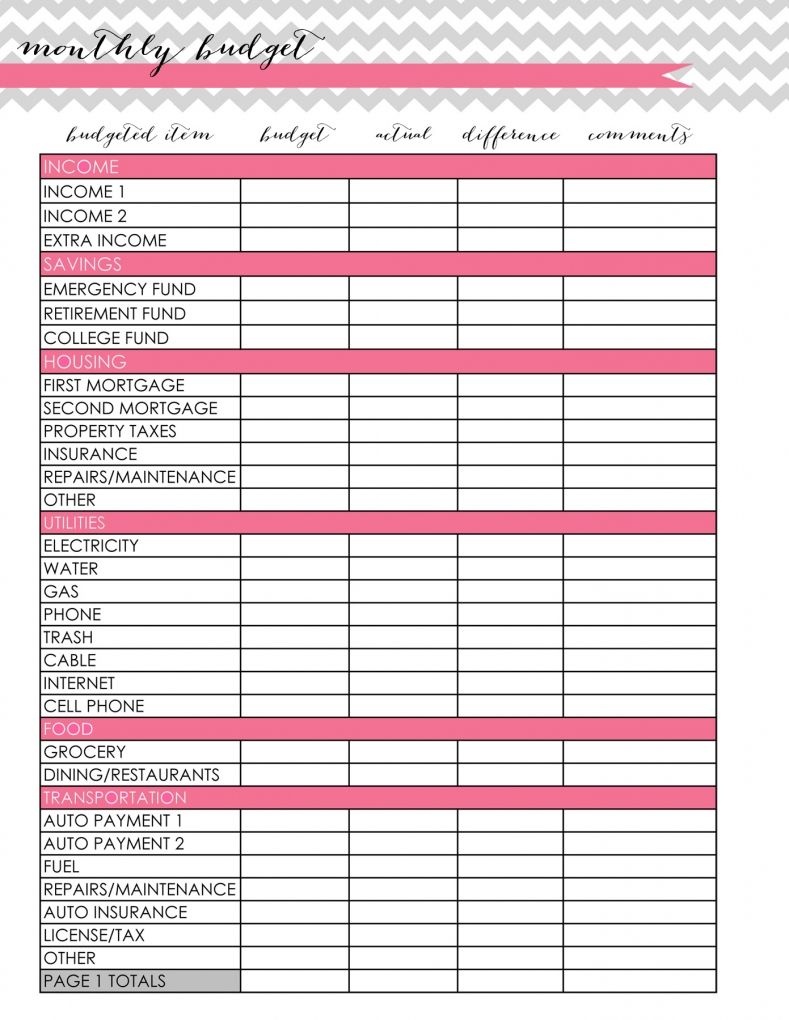

Your budget needs to work for you and your lifestyle so it's important to adjust your budget as things change.įor example, if your expenses start to increase you may need to reduce your spending, or change your savings goal. Even a small amount set aside regularly will make a difference. Having some savings can create a safety net for unexpected expenses. Once you know how much money you have for 'wants', you can work out how much of it you'd like to save. If you have a savings goal you can use your budget to work towards it. This will help you to see where it goes and keep within your spending limit. Make a plan for what you want to do with your spending money. Your spending money is for 'wants', such as entertainment, eating out and hobbies. The money you have left after expenses is your spending and saving money. If you tracked your spending, use your list of transactions. Include what the expense is for, how much and when you pay it. To make sure you've recorded all your expenses, look at your bills or bank statements.

PERSONAL BUDGET MANAGEMENT REGISTRATION

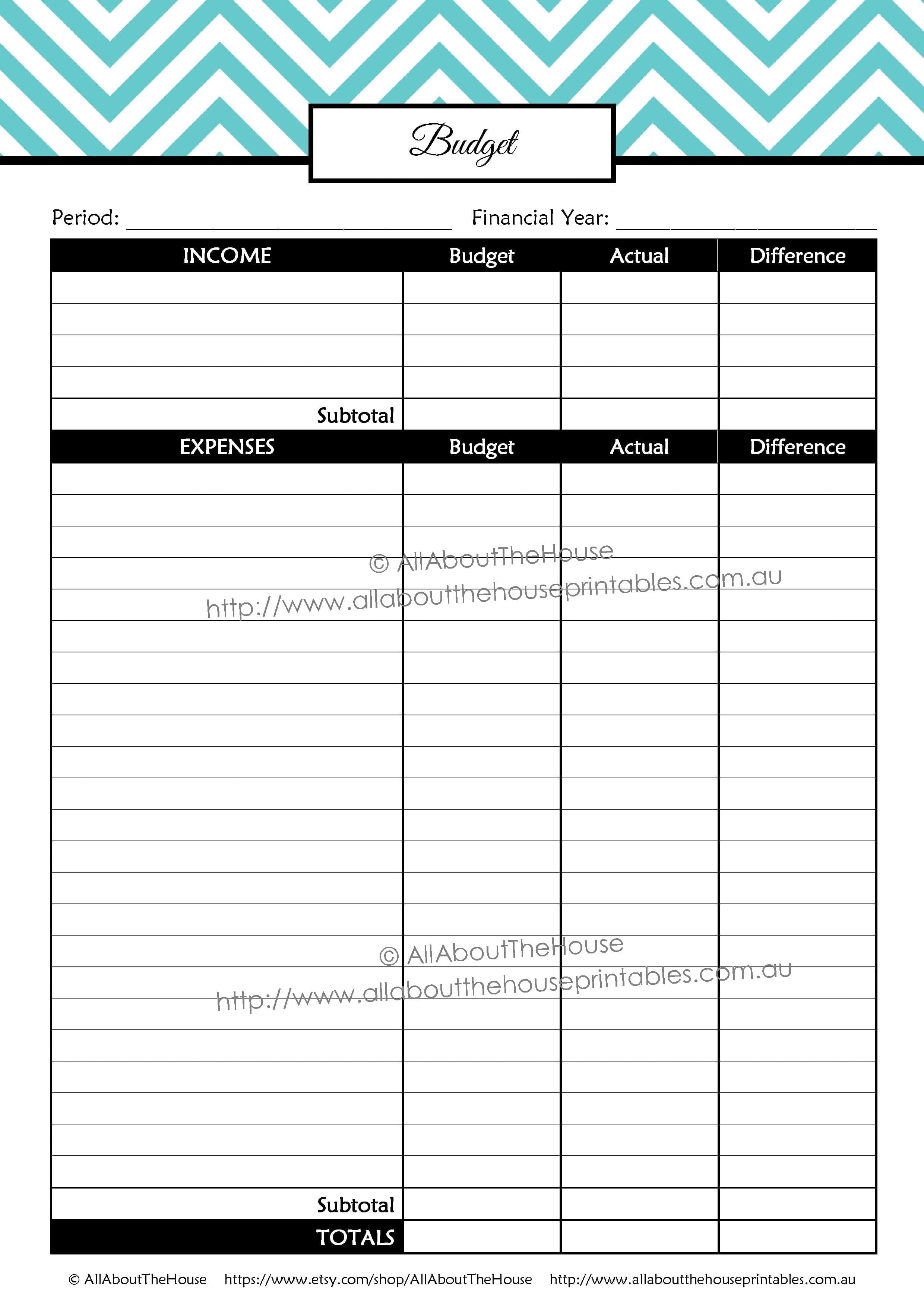

If you don't have a regular amount of income, work out an average amount. Record how much money is coming in and when.

For example, if you get paid weekly, set up a weekly budget. Use how often you get paid as the timeframe for your budget. You can put aside money for bills and expenses and set up a plan to reach your financial goals.įollow these steps to get started. This type of decision is common in budget management.Having a budget helps you see where your money is going. Instead, the manager must project how long it is expected to take to acquire the necessary funds to purchase the desired equipment. Payroll is a budgetary expense that cannot be spent arbitrarily or sacrificed for other costs. For instance, a manager may have to postpone purchasing a new piece of equipment that has the potential to help the company produce more in order to make payroll. Careful decisions have to be made regarding the amount of money spent each month on specific items. Bad management of money often leads to severe shortfalls in cash and can put a business in real jeopardy.Ī typical budget allocates funds for payroll, general expenses, equipment, services, taxes and miscellaneous expenditures. When a budget is out of balance, the manager must find ways to increase or reduce spending in certain areas.Ī company relies on good budget management in order to operate on a daily basis without going into chaos. Managing any budget requires a constant balancing act of maintaining good levels of cash flow without going over the budget limit. A budget also keeps track of incoming profits. A budget normally allocates specific amounts of money to various items that require funding.

0 kommentar(er)

0 kommentar(er)